IT Support for Financial Services

Award-winning IT support for financial services providers.

For more than 40 years, CSI has been helping financial services providers transform with compliant, secure IT support, guidance and advice.

Compliant, effective IT support for financial services.

Banks, building societies, and financial services (FS) providers need superfast and secure IT. Winning security battles, providing highly valuable customer experiences online, and securing data are all high priorities for FS professionals. With regulatory headwinds to navigate and cost-efficiencies to gain, CSI has helped many financial services providers transform with award-winning IT support.

After the global pandemic, banks and building societies migrated to cloud platforms, began to strategize data growth initiatives, and tightened security controls. Bankers in particular have been impacted by rapid change, competition with the rise of challenger banks, and the headache of security issues and unpredictable cloud costs.

At CSI, we are in constant conversation with banks and building societies to help design and deploy IT services, whether AI, cloud support, cybersecurity solutions, or beyond.

A Different Conversation Starts Here →

Our financial services IT support solutions are designed to scale to today’s most pressing challenges, including ransomware, competitive deployment of technology, cloud computing, and more.

It takes less than 2 minutes to complete our form and we’ll reach out within 24 hours to help!

How Can We Help?

"*" indicates required fields

Countless financial service providers trust us

Our specialists have been trusted advisers in helping building societies, banks and investment firms transform, secure and evolve with the times.

How CSI tailors IT support for banks, building societies, fintech & investment firms.

Every year, CSI supports countless financial service providers to modernise and transform with new technologies. Going beyond typical IT support, we help unlock further value from under-optimised cloud investments.

We understand that there’s no one-size approach to your challenges as an FS professional, which is why we tailor our IT support. You can get transparent, simple strategies on re-optimising cloud costs, discuss AI applications that transform customer experiences, and discuss cybersecurity controls for data safety.

Benefits of financial services IT services.

Managed services for IT can unlock a range of benefits for financial services that are known to optimise costs, handle data volumes at scale, enhance customer satisfaction, and overall offer market-leading performance and security.

- Adopt emergent and relevant technologies at the right time

- Deliver optimal user experience around the clock

- End-to-end application assurances

- Operational assurances

- Cyber security best practice

- Break into AI technologies

Whether your goal is about cost-efficiency, security, compliance, or you need to rethink your competitive edge, our experienced experts are on-hand to advise on, and deploy, award-winning IT support and solutions.

Popular services for the financial sector

Benefits of CSI’s IT support for financial services providers.

Accredited to exacting industry-leading frameworks and partnering with Microsoft and other cloud providers, CSI is uniquely positioned to offer the most competitive solutions and support across the market. Independent, certified expertise, CSI benefits firms like yours by driving meaningful transformation from the inside out.

- Minimise disruption from digital risks

- Optimise IT to improve end-user experience

- Ensure application efficiency and performance

- Operational assistance when you need it

- Unlock your cloud investment, including Microsoft Azure

- Leverage a modern office with Azure Virtual Desktop and MS Office

- Modernise your infrastructure and applications

New capabilities are reaching your market.

PwC sees the Global Financial Services technology sector taking these five key capabilities to market:

#1. Digital transformation

Business process transformation, CRM, mobile and core systems transformation

#2. Analytics & new technology

Advanced analytics, Big Data, cryptocurrencies, robotics and artificial intelligence

#3. CIO advisory

Enterprise architecture, IT sourcing, IT governance, cloud, cost & value / ops & service management

#4. Risk & regulatory technology

IT risk & resilience, financial crime, Know Your Customer, GRC, customer compliance

#5. Cyber security

Risk management, threat intel & management, incident response, identity & access management

Book a free technology demo today.

We’ve simplified innovation with our state-of-the-art Demo Suite. See Hybrid Cloud, HCI and HPC technologies in action before you invest and discover new ways to store, scale, secure and optimise your critical workloads.

Challenge #1

Troubled cyber security posture.

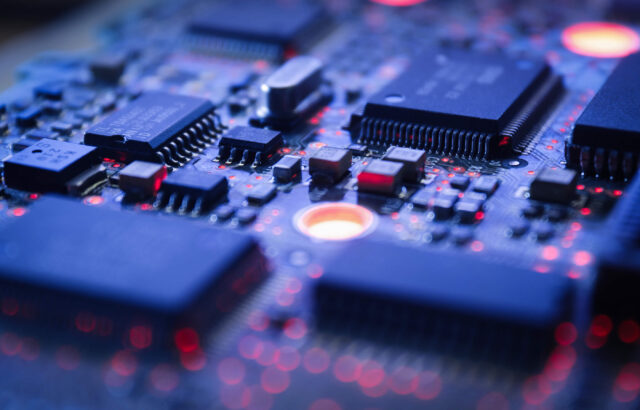

Cyber security is consistently a top priority in almost every survey of IT decision makers. Ransomware is one of the fastest-growing security concerns across most industries, affecting corporations, government agencies and private entities alike. What’s more concerning, the sensitive nature of your data puts financial professionals at greater risk.

Vulnerabilities can range from old unsupported hardware, an unpatched operating platform and a lack of security awareness among staff – did you know the majority of breaches can be traced to human error? IT solutions need to be supported by a security-ware culture where every employee is a player in the line of cyber defence.

Challenge #2

Achieving (and maintaining) regulatory compliance is no small feat.

The financial services sector is already one of the most heavily regulated industries and as the industry turns to new technologies, governing bodies introduce new regulations and maintaining compliance can be tough. Any failure to meet guidelines can open a company to the risk of data breaches, reputational damage, and the possibility of financial penalties, or worse.

CSI recognises the importance of designing infrastructure to support these requirements – from the FCA’s CQUEST cyber resilience assessment and SYSC 8.1 outsourcing requirements, to the PRA SS2/21 Supervisory Statement on managing third-party risk – including how to plan for a rapid stressed exit from a public cloud provider.

Challenge #3

Outdated infrastructure becoming a risk?

Ageing hardware – sometimes called legacy systems – can be the cause of poor performance and lack of flexibility. Out of support systems may still work, but there is an increased risk of failure or cyber breach when patches are no longer available, and worse may result in failed regulatory audits.

“Born-in-the-cloud” new entrants are not hindered by legacy and can take advantage of innovative technology like containerisation, serverless computing and hybrid multicloud models where workloads can run on any platform. However, we’ve seen companies grow and beat the competition by enjoying the best of both worlds – retain core systems rich with institutional knowledge and exploit emerging IT trends.

The CSI Difference

0 +

CSI’s experts have over 900 years of combined experience supporting and managing IBM Power Systems.

0 %

of CSI employees are in client-facing roles, providing best in class customer service.

0 YEARS

CSI’s history of innovation has earned us credibility as a reliable, trusted partner of choice around the world.

I’m confident that we’ve chosen the right technology partner to set us up for the next 5-10 years ahead.

Simon Thompson, CFO – Key Read more

Unlocking Opportunity for our Clients

Financial Services & Insurance

Darlington Building Society

Learn how Darlington adopted the cloud to improve the performance and reliability of their business critical application.

Financial Services & Insurance

Buckinghamshire Building Society

Learn how Buckinghamshire Building Society grew its business with confidence, knowing supporting IT systems were efficient, effective and secure.

ISV

FNZ

Learn how wealth management leader FNZ delivers fintech apps via Software as a Service model and is automating software testing…